marin county property tax rate

MARIN COUNTY PROPERTY OWNERS From. For comparison the median home value in Marin County is 86800000.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

One mill equals 100 per 100000 of property value.

. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. That is nearly double the national median property tax payment. The minimum combined 2022 sales tax rate for Marin County California is.

Tax Rate Book 2012-2013 If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days in. A propertys original base value is its 1975-1976 market value and can be adjusted each year by no more than 2 to account for inflation. If you have questions about the following information please contact the Property Tax Division at 415 473-6168.

The California state sales tax rate is currently. Send the correct installment payment stub 1st or 2nd when paying your bill. Marin property tax revenue takes big jump for 2022 People are taking that long-awaited vacation she said and simultaneously weve.

Marin County Property Search. The property tax rate in the county is 078. Transfer tax can be assessed as a percentage of the propertys final sale price or simply a flat fee.

Secured property tax bills are mailed only once in October. 20 counties have higher tax rates. The county provides a list of exemptions for property tax items that apply tour property.

Marin County has one of the higher property tax rates in the state at around 1108. California State Sales Tax. The Marin County sales tax rate is.

Proposition 13- Article 13A Section 2 enacted in 1978 forms the basis for the current property tax laws. This is the total of state and county sales tax rates. Calculating The Transfer Tax in Marin County.

The median property tax also known as real estate tax in Ross County is 114800 per year based on a median home value of 11180000 and a median effective property tax rate of 103 of property value. What is the sales tax rate in Marin County. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Marin County Tax Appraisers office.

To calculate the amount of transfer tax you owe simply use the following formula. 36 out of 58 counties have lower property tax rates. Marin County Sales Tax.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The total sales tax rate in any given location can be broken down into state county city and special district rates. Penalties apply if the installments are not paid by December 10 or April 10 respectively.

Ross County collects relatively high property taxes and is ranked in the top half of all counties in the United States. Marin County Property Tax. Note that 1108 is an effective tax rate estimate.

Of the fifty-eight counties in. Property Tax in Marin County. Tax Rates By City in Marin County California.

Learn About Your Senior Exemptions. View 2021 Millage Rates. California has a 6 sales tax and Marin County collects an additional 025 so the minimum sales tax rate in Marin County is 625 not including any city or special district taxes.

Your property taxes would remain at 3500 instead of the new rate of about 12500 per year for a 1M house. San Rafael City Sales Tax. California State Property Tax.

California State Income Tax. The Marin Wildfire Prevention Authority Measure C is a special tax charged to all parcels of real property located in Marin County within the defined boundary of the Member Taxing Entities. Historically Marins property tax revenue has grown at an average rate of about 54 percent annually just fast enough to cover 3 cost-of-living adjustments for county employees.

This calculator is excellent for making general property tax comparisons between different states and counties but. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. Marin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

The median property tax also known as real estate tax in Marin County is based on a median home value of and a median effective property tax rate of 063 of property value. The tax year runs from January 1st to December 31st. For example the property taxes for the home that you have owned for many years may be 3500 per year.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other taxing authorities set the millage rates. The Tax Rate Area number is. Secured property taxes are payable in two 2 installments which are due November 1 and February 1.

If you are planning to buy a home in Marin County and want to understand the size of your property tax bill and other home information use the Marin County Property Lookup Tool. The voters approved this parcel tax in March 2020 by approximately 71 for a period of ten years starting with the 202021 fiscal year. Enter a search term Search.

Director of Finance County of Marin TAX RATE AREAS This booklet which includes all of the Marin County Tax Rate Areas 1027 has been prepared for informational purposes by my office breaking down the tax rates of the various governmental entities which tax your property for the fiscal year 2009-2010. ARROW Auditor-Controller County of Marin TAX RATE AREAS This booklet which includes all. Assessed valueis calculated based on market value using a base year value.

Transfer Tax In Marin County California Who Pays What

The Virtual Tools Built To Fix Real World Housing Problems Bloomberg

221 Marin County Apartments Change Hands In 188 Million Of Deals

Biden S Capital Gains Tax Hike Could Spark A Big Sell Off In Stocks Here S What That Means For The Market

Covid 19 Case Rates Drop In Senior Facilities Post Vaccine

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

For Seniors Keeping Your Property Taxes Low

Marin Wildfire Prevention Authority Measure C Myparceltax

This Bay Area County Is Faced With Some Of The Highest Property Taxes In The Country Abc7 San Francisco

Property Taxes By County Where Do People Pay The Most And Least

Marin County California Property Taxes 2022

Marin Pilot Program Aims To Entice Landlords To Accept Section 8 Being A Landlord Entice Pilot

This Bay Area County Is Faced With Some Of The Highest Property Taxes In The Country Abc7 San Francisco

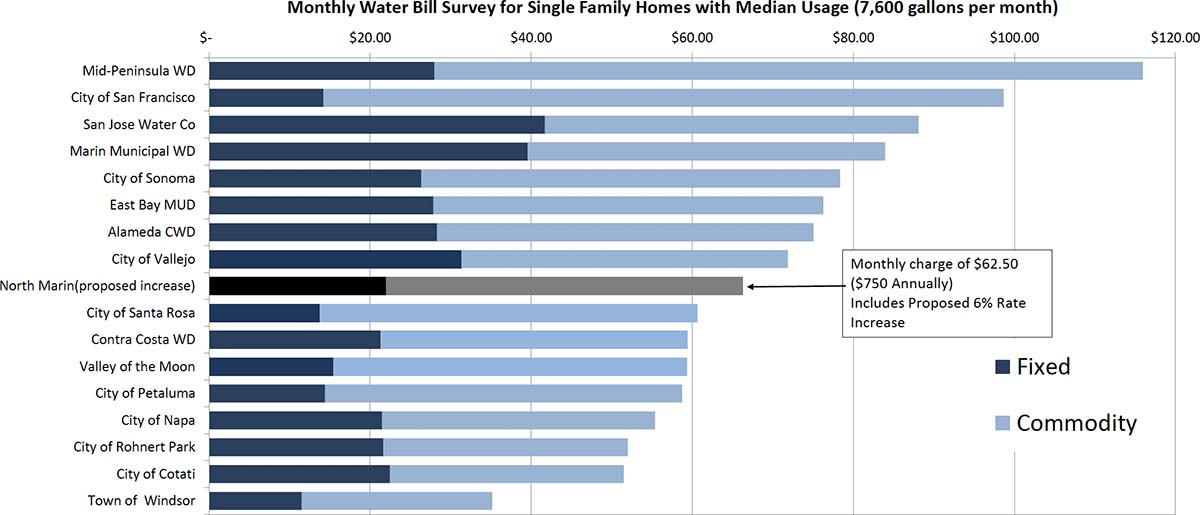

Rates North Marin Water District

Marin Wildfire Prevention Authority Measure C Myparceltax

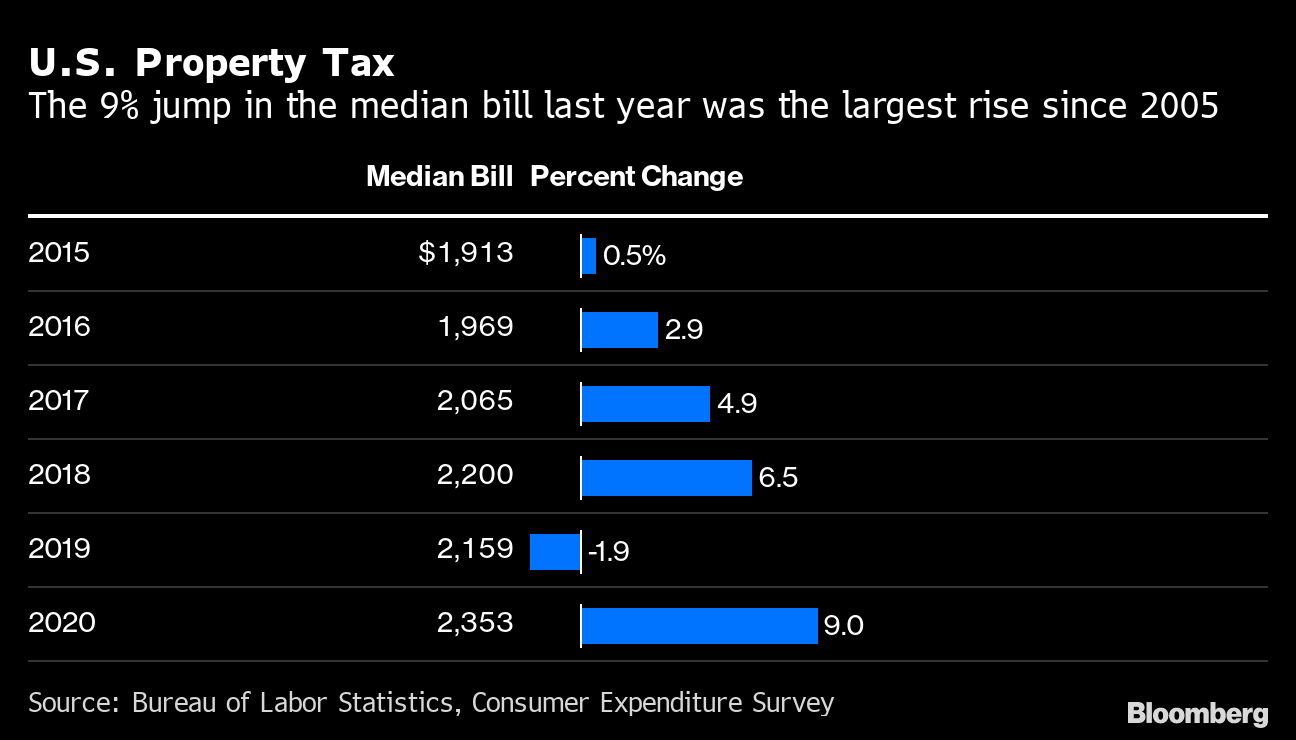

Historic Home Prices To Whack Owners In Next Year S Property Tax Bloomberg